Defining Alabama Employee (Suta)

and Security Assessment Taxes

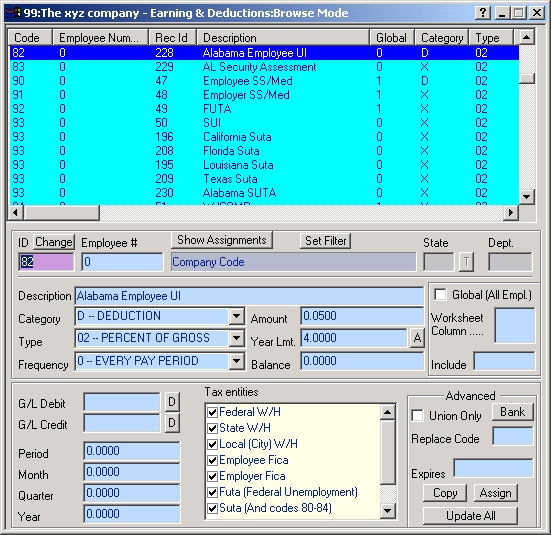

Company Level Code defining the Employee SUTA Deduction

(Percentage Based)

NOTE: ALABAMA NO LONGER HAS AN

EMPLOYEE SUTA DEDUCTION, THIS INFORMATION IS FOR HISTORIC REPORTING

ONLY.

The XYZ Company sets up the Alabama

Employee Tax (Suta) code as follows:

-

For this sample, the wage base is $8,000.

-

The Employee Suta rate is .05% (for this sample

company -- often this rate is 0.00%)

-

The maximum per tax year is $4.00. ($8,000 x .06%)

One Company Level Code is required to automate the Employee

Suta as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

82

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 84 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes - Taxation of codes

80-84 are handled in the same maner as the SUTA code (code 93) |

| Description |

Alabama Employee UI |

The text AL

and UI are both required here. Any other description

is optional. |

| Category |

D

|

Employee Tax. |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.05

|

For this sample company the rate is .05 % (or .0005) |

| Limit |

4.00 |

For this sample, the wage base limit is 8,000 so 8000

x .05% = 4.00 |

| Balance |

0 |

No Balance is required for tax codes. |

| Tax Entities |

All checked |

This tax is not a pre-tax deduction to any other tax.

|

| Global |

Checked |

Mark this global if all employees of the company are

liable for this tax. |

NOTE: ALABAMA NO LONGER HAS AN EMPLOYEE SUTA

DEDUCTION, THIS INFORMATION IS FOR HISTORIC REPORTING ONLY.

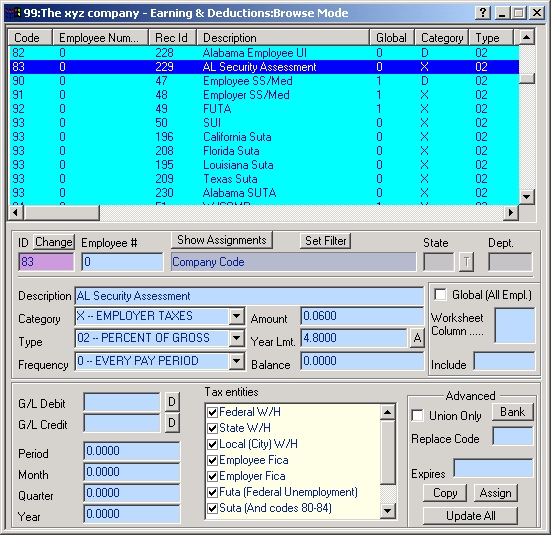

Company Level Code defining the HI Employer Tax (Percentage

Based)

The XYZ Company sets up the ESA code as follows:

- For 2005, the ESA wage base is $8,000.

- The tax rate is .06%.

- The maximum per tax year is $4.80. (8000 * .0006)

One Company Level Code is required to automate the HI

tax as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

83

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 84 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes - Taxation of codes

80-84 are handled in the same maner as the SUTA code (code 93) |

| Description |

AL Security Assessment |

The text ESA

or Security are required here. Any other description

is optional. |

| Category |

X

|

Employer Taxes |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.06

|

For 2005 the tax rate is .06% |

| Limit |

$4.80 |

For 2005, the base wage limit is $8,000. So 8000 x

.0006 = 4.80 |

| Balance |

0 |

No Balance is required for tax codes. |

| Tax Entities |

All checked |

This tax is not a pre-tax deduction to any other tax.

|

| Global |

Checked |

Mark this global if the company is liable

for this tax, for all employees of the company. |

If you wish to make the payment for these taxes via the

CCS Payroll Program, add the necessary banking information by clicking

on the Bank button. Remember to click the "Show Address" checkbox

and fill in the agency name & address if you will be paying with a paper

check. Also click on the Multiple Weeks checkbox unless you want each

pay period's line item listed separately.

Note: If you pay SUTA taxes to more than one state, you

will need to assign these codes specifically to those employees that

are subject to this tax, and un-check the Global option.

Hint: If you link this code to your AL Suta code, it will

always appear on the paycheck when your AL Suta code appears. See Links

with code for further information.

The example above is for Alabama employers; however,

the CCS Payroll program has the ability to incorporate and handle any

state or local tax requirement.