|

|

Creating a Bonus Check Run (at 25% taxation)

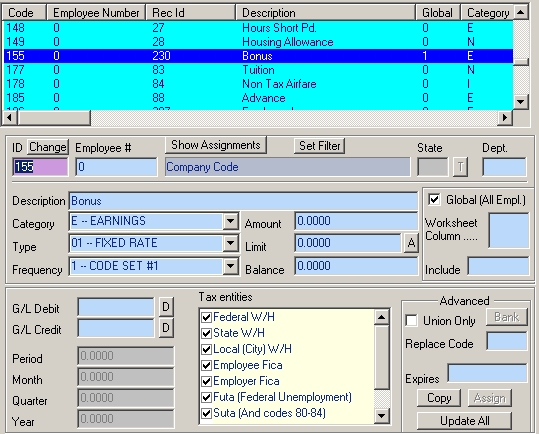

Also see the topic: Tax Period Override for creating a payroll run based on an overridden taxation period. (Quarterly Bonus checks for example.) 1st Define a Bonus code if you do not already have

one:

Note: We used a Frequency of "1" to prevent this

code from showing up during a normal payroll run -- We'll explain further

below.

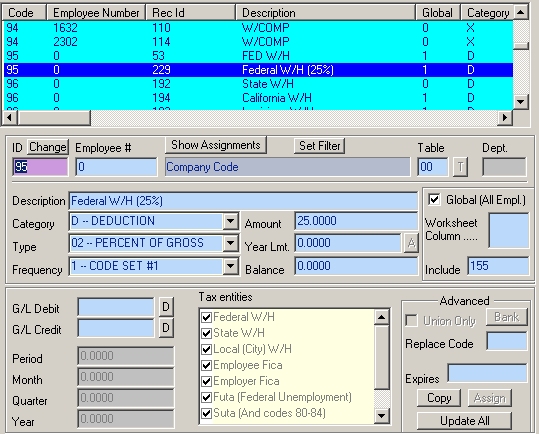

Next create a 25% Federal W/H code.

Note: both the Frequency and the Include

field.

We have set both codes to be global

codes, but they will not show up unless the payroll run calls for "Code Set

1", or specifically includes these codes. Also since the Include field will

only look at the bonus code, the amount will be based on the bonus code only.

This is not absolutely necessary; however, since you will

probably restrict the codes on a bonus paycheck anyway.

Now we are ready to create the Bonus

run.

Note: the values in the Frequency area -- These are

the only codes we want for this payroll run. They are enclosed in Parenthesis

( ), this tells the system that you want these codes and no others

on this check. If the values are not enclosed in parenthesis, it interprets

the values as to which code set you want. See the Help system on

Frequency for further information if you wish to understand this concept

in greater detail.

Click Create Checks for a semiautomatic run (if you

have quite a few bonus checks to produce -- skipping those not to be included),

otherwise, use the manual mode and enter the employee numbers (in the

paycheck entry screen) for those individual employees who are to receive

the bonus check.

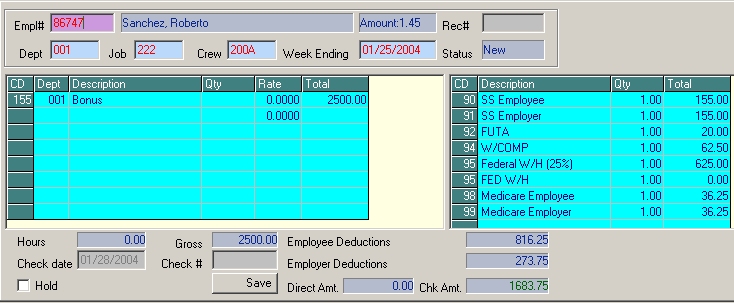

Above is the completed check.

Note: We zeroed out the FED W/H code (normal tax

rate) and let the 25% calculate. If you have quite a few checks to create,

you can temporarily mark the normal FED W/H code as not global (un-check

the Global check box) to prevent it from showing on the paycheck entry

screen.

That's it. Print your checks as normal.

And yes, you can have as many checks in a

particular week ending as needed, and each check run can have a different check

date (or the same check date). When the system sees different check dates in a

single pay period, you will be asked which check date to base some tax type

reports on as you print them.

As mentioned above, this is just one example of how to setup a bonus run. If you have the Express version, or a non-multistate company, you will not be able to create the 2nd Fed W/H code as shown above. In this case, temporarily set the amount field to 25% (or whatever rate is applicable) for the current Fed W/H. Be sure to remove the amount after you have created your checks, so the normal table rate is applied.

Note: The setup above is somewhat complex, and is really only needed when you often do bonus runs. If this is something you rarely do, or do for very few employees, and would rather not automate bonus runs, then simply create a bonus code, and create a manual check. Edit the federal and state W/H amounts manually as required. An alternative method of processing bonus paychecks is discused in the topic: Tax Period Override .

Please let us know if you need any further

assistance on creating a bonus check run.

|