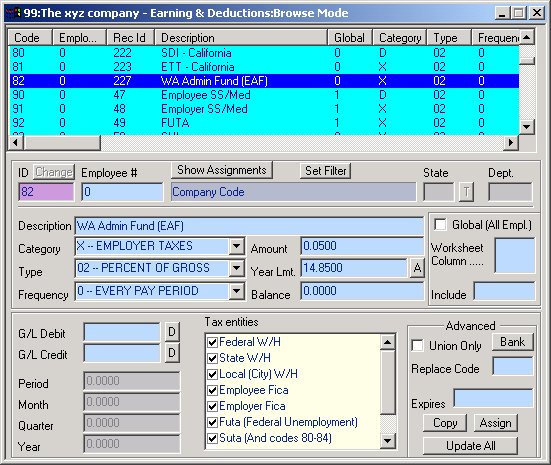

Defining the Washington EAF Tax Code

Company Level Code defining the "EAF" tax (Percentage

Based)

The XYZ Company sets up the Washington EAF code as

follows:

- One Company Level Code is required to automate the EAF (Employement

Administration Fund) as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

82

|

The number assigned to this

Code is determined by the user who created it. The only limitation

is that they be between 80 and 89 due to the fact that these codes

have been especially set up in CCS Payroll for State and Local other

taxes. |

| Description |

WA Admin Fund (EAF) |

The letters EAF

are required. Any other additional

description is optional. |

| Category |

X

|

Employer Tax |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

.05

|

Enter the applicable Percentage |

| Limit |

14.85 |

The Limit field is based on a yearly limit -- for

2003 the base wage limit was $29,700 |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pre-tax deduction as far as these

withholding taxes are concerned. |

| Global |

UnChecked |

If all employees of the Company are considered for

this taxation click the Global box, otherwise assign it specifically

to those employees who the tax is applicable to. |

If you wish to make the payment of this tax via the CCS

Payroll Program, add the necessary banking information by clicking on

the Bank button. Remember to click the "Show Address" checkbox

and fill in the agency name & address if you will be paying with a paper

check. Also click on the "Multiple Weeks" checkbox unless

you want each pay period's line item listed separately.