Defining NJ Payroll Codes

The following examples are using base rates for new

employers for the year 2003. If your situation is different than depicted

in these examples please make the necessary changes. If you have any

questions contact CCS for help.

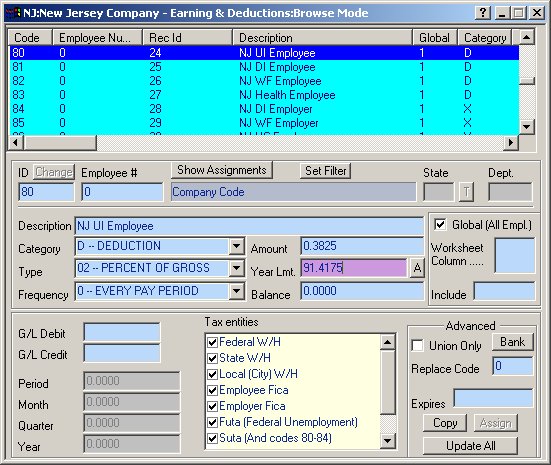

Company Level Code defining the UI Deduction for

the Employee (Percentage Based)

Set up the Employee UI code as follows:

- The UI wage base for 2003 - $23,900.

- The base UI rate for employees for 7/1-12/31 2003 is 0.3825%.

- Yearly Limit (23,900 *0.3825%) = $91.4175

One Company Level Code is required to automate the Employee

side of the UI as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

80

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ UI Employee |

The text UI

or Unemp are required here. Any other

description is optional. |

| Category |

D

|

Deduction |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.3825

|

Enter the correct percentage amount here for your

company |

| Limit |

$91.4175 |

(23,900 *0.3825%) = $91.4175 |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

All employees of a New Jersey company are liable for

this tax. |

NOTE: If you wish to make the UI payment (or any agent/vendor

payment) via the CCS Payroll Program, add the necessary banking information

by clicking on the Bank button from within that particular code. Remember

to click the "Show Address" checkbox and fill in the agency

name & address if you will be paying with a paper check. Also, click

on the Multiple Weeks checkbox unless you want each pay period's line

item listed separately. For more detailed information on making payments

to agents/vendors through CCS Payroll, see Disbursements Form in the

Help Index. Specifically, look at the section Bank Button.

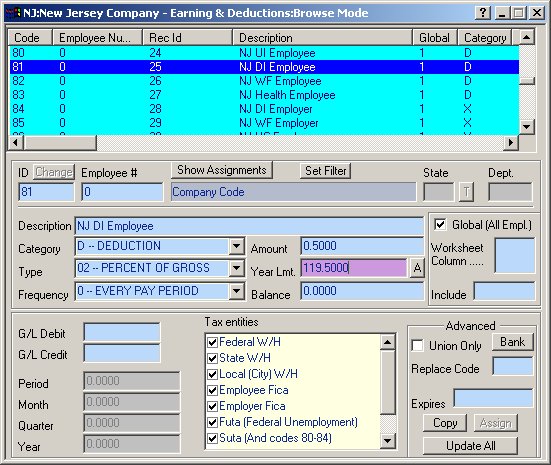

Company Level Code defining the Disability Employee

Tax (Percentage Based)

Set up the DI code as follows:

- The DI wage base is $23,900.

- The DI rate in 2002 is .5%.

- The maximum per tax year is $119.50. (23,900 *.5%).

One Company Level Code is required to automate the Employee

side of the DI as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

81

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ DI Employee |

The text DI

or Disability are required here. Any other description is

optional. |

| Category |

D |

Deduction |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.500

|

Enter the correct percentage amount here for your

company |

| Limit |

$119.50 |

(23,900 *.5%). |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

All New Jersey Employees are liable for this tax. |

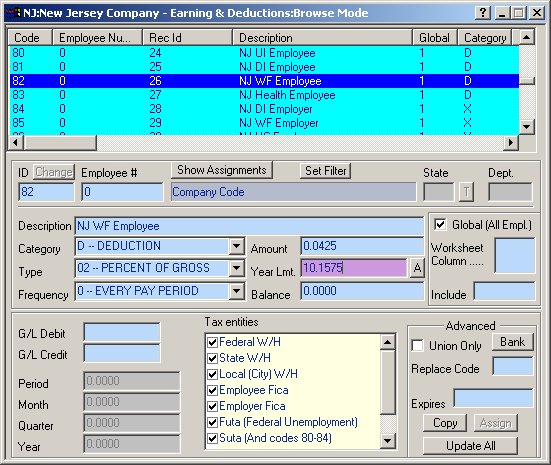

Company Level Code defining the Workforce Employee

Tax (Percentage Based)

Set up the WF code as follows:

- The WF wage base is $23,900.

- The WF rate is .0425%.

- The maximum per tax year is $10.1575. (23,900 *.0425%).

One Company Level Code is required to automate the Employee

side of the Workforce tax as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

82

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ WF Employee |

The text WF

or Workforce are required here. Any other description is

optional. |

| Category |

D

|

Deduction |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.0425

|

|

| Limit |

$10.1575 |

(23,900 *.0425%). |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

New Jersey Employees are liable for this tax. |

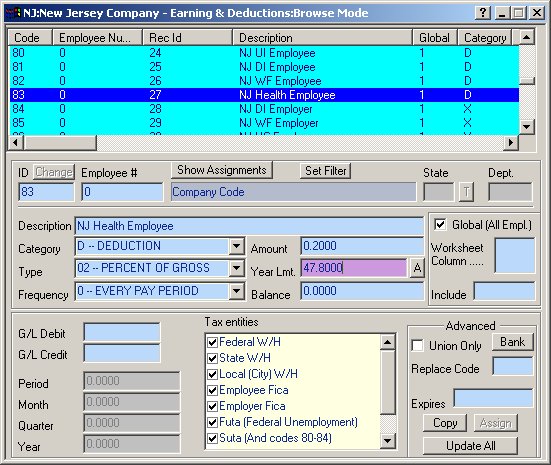

Company Level Code defining the Healthcare Employee

Tax (Percentage Based)

Set up the Healthcare code as follows:

- The HC wage base is $23,900.

- The HC rate is .2%.

- The maximum per tax year is $47.80. (23,900 * .2%).

One Company Level Code is required to automate the Employee

side of the Health Care tax as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

83

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ HC - Employee |

The text HC

or Health are required here. Any other description is

optional. |

| Category |

D

|

Deduction |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.200

|

|

| Limit |

$47.80 |

23,900 * .2% |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

New Jersey Employees are liable for this tax. |

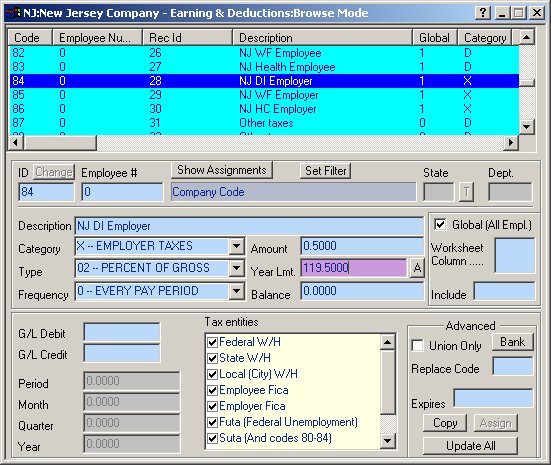

Company Level Code defining the Disability Employer

Tax (Percentage Based)

Set up the Disability code as follows:

- The DI wage base is $23,900.

- The DI rate is .5%.

- The maximum per tax year is $119.50. (23,900 * .5%).

One Company Level Code is required to automate the Employer

side of the DI as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

84

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ DI - Employer |

The text DI

or Disability are required here. Any other description is

optional. |

| Category |

X

|

Employer Taxes |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.5

|

|

| Limit |

$119.50 |

23,900 * .5% |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

New Jersey Employers are liable for this tax. |

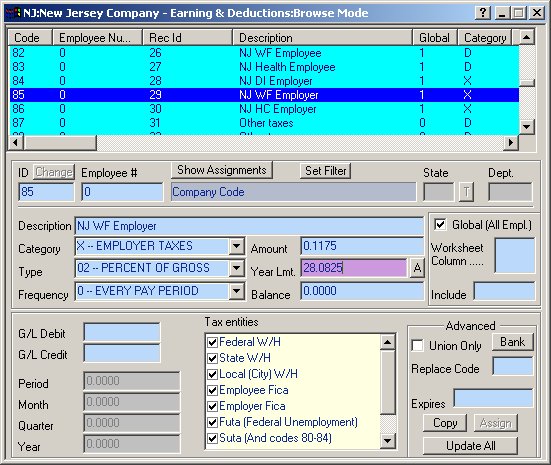

Company Level Code defining the Workforce Employer

Tax (Percentage Based)

Set up the WF code as follows:

- The WF wage base is $23,900.

- The WF rate is .1175%.

- The maximum per tax year is $82.0825. (23,900 * .1175).

One Company Level Code is required to automate the Employer

WF as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

85

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ WF - Employer |

The text WF

or Workforce are required here. Any other description

is optional. |

| Category |

X

|

Employer Taxes |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.1175

|

|

| Limit |

$28.0825 |

23,900 * .1175 |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

New Jersey Employers are liable for this tax. |

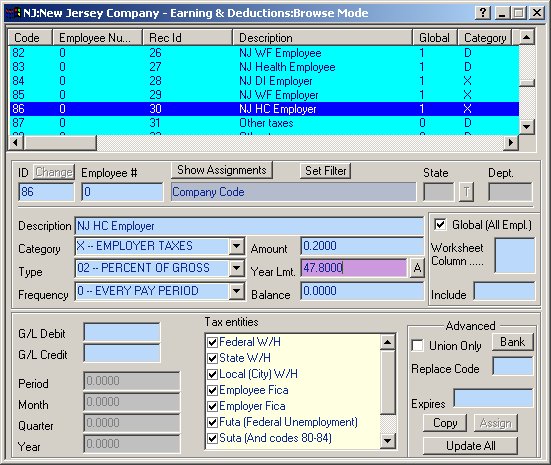

Company Level Code defining the HC Employer Tax

(Percentage Based)

Set up the HC code as follows:

- The HC wage base is $23,900.

- The HC rate is 0.2% for 1/12003-6/30/2003 (the rate changes to

0.00% for 7/1/2003-12/31/2003).

- The maximum per tax year is $47.80. (23,900 * .2%).

One Company Level Code is required to automate the Employer

HC as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

86

|

The number assigned to this Code is determined

by the user who created it. The only limitation is that they be

between 80 and 89 due to the fact that these codes have been especially

set up in CCS Payroll for State and Local taxes. |

| Description |

NJ HC - Employer |

The text HC

or Health are required here. Any other description is optional. |

| Category |

X

|

Employer Taxes |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.2

|

The HC rate is 0.2% for 1/12003-6/30/2003 the rate

changes to 0.00% for 7/1/2003-12/31/2003. If you have a rate assigned

please fill it in the amount field. |

| Limit |

$47.80 |

23,900 * .2% |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

New Jersey Employers are liable for this tax. |

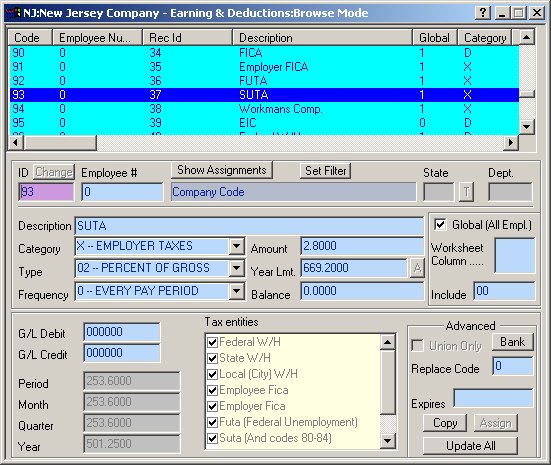

Company Level Code defining the State Unemployment

Insurance Employer Tax (Percentage Based)

Set up the SUI (SUTA) code as follows:

- The SUTA wage base is $23,900.

- The SUTA rate is the experience rating assigned to this particular

company. We will use 2.8% for instruction purposes.

- The maximum per tax year: The program will calculate this for

you. Using the experience rating of 2.8% it would be $669.20. (23,900

* 2.8%)

- The program will automatically calculate the Year Lmt. once the

rate has been entered into the Amount field based upon the SUTA

wage base.

One Company Level Code is required to automate the SUTA

as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

93

|

This code is predefined by CCS and has

been especially set up in CCS Payroll for State SUTA calculation. |

| Description |

NJ SUTA |

You may edit this description,

however the use of code 93, is only for SUTA(SUI) |

| Category |

X

|

Employer Taxes |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

2.8

|

This amount is your experience rating. We have entered

2.8 for instruction puropses. This is the 2003 New employer rate. |

| Limit |

$669.20 |

Wage base x amount ($23,900 x 2.8%). This is calculated

based on 2.8% as the experience rating. Your Limit will be different

if you have a different experience rating. |

| Balance |

0 |

|

| Tax Entities |

All checked |

This Code is not a pre-tax deduction to any other

tax |

| Global |

Checked |

New Jersey Employers are liable for this tax. |

Please follow the instructions in the QuickStart Guide

to automate any other Earning & Deduction type codes you will require.

Please review the section on State Tax Setup to ensure that all necessary

codes have been created/edited.

The Example above is for New Jersey employers; however,

the CCS Payroll program has the ability to incorporate and handle any

state or local tax requirement.