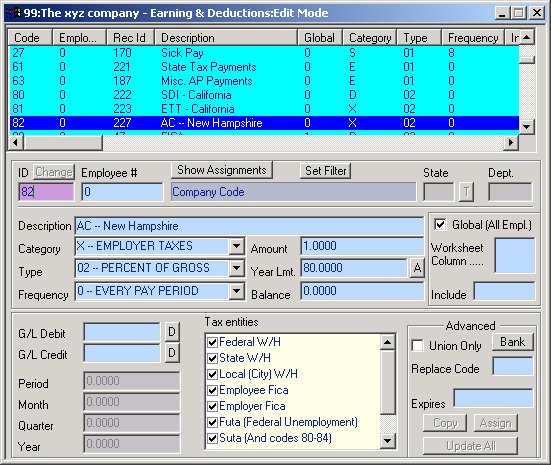

Defining the New Hampshire AC deduction

Company Level Code defining the "AC" tax (Percentage

Based)

The XYZ Company sets up the NH "AC" code

as follows:

- The Administrative rate is 1.00%

One Company Level Code is required to automate the AC

tax as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

82

|

The number assigned to this

Code is determined by the user who created it. The only limitation

is that they be between 80 and 89 due to the fact that these codes

have been especially set up in CCS Payroll for State and Local taxes. |

| Description |

AC - New Hampshire |

The letters AC

or ADMIN are required. Any other

additional description is optional. |

| Category |

X

|

Employer Tax |

| Type |

02

|

Percent of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

1.00

|

Enter the applicable Percentage |

| Limit |

80.00 |

The Limit field is based on a yearly limit -- for

2003 the base wage limit was $8000.00 |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pre-tax deduction as far as these

withholding taxes are concerned. |

| Global |

Checked |

If all employees of the Company are liable for this

tax. |

If you wish to make the payment of these taxes via the

CCS Payroll Program, add the necessary banking information by clicking

on the Bank button. Remember to click the "Show Address" checkbox

and fill in the agency name & address if you will be paying with a paper

check. Also click on the Multiple Weeks checkbox unless you want each

pay period's line item listed separately.

The Example above is for New Hampshire employers;

however, the CCS Payroll program has the ability to incorporate and

handle any state or local tax requirement.